About Us

Vantage Infrastructure is an independent infrastructure specialist manager committed to delivering sustainable investment solutions as a long-term partner

0

PEOPLE1

0

NATIONALITIES

0%

WOMEN1

0/5

STAFF OWNED

0

INVESTMENTS

>$0.8b

AUM2

0★

2023 RATING IN 2 OF 4 PRI MODULES; 4 STARS AWARDED THE OTHER 23 Vantage pays membership fees to PRI.

0★

2023 EQUITY RATING3 Vantage-managed portfolio companies pay membership fees to GRESB

Who We Are

Vantage Infrastructure comprises an experienced team, long-standing institutional relationships and a diverse equity and debt infrastructure investment portfolio formed from the international business of Hastings Funds Management.

What We Do

We manage over 80 investments in the energy, environment, transportation, data infrastructure and social infrastructure sectors across Europe, North America and Australia. Our primary focus is to deliver superior, sustainable risk-adjusted returns through the most suitable investment solutions we can offer to our clients.

MANDATES

Bespoke solution for individual clients aimed to deliver specific target return and/or yield objectives. Our mandates can cover single or multiple assets, target closed or open-ended products and offer full investment life cycle services or focus on asset management

FUNDS

Focused investment products targeting pre-defined risk, return and/or yield profiles with certain sector and/or geographical focus

CO-INVESTMENTS

Investment alongside a pooled vehicle in specific target private infrastructure companies

What We Stand For

We believe success is built from encouraging openness of communication and diversity of thought. We are a responsible, entrepreneurial firm focussed on developing long-term relationships with our investors, our shareholders, our investee companies, our industry partners and our network of advisers. We are passionate about our commitment to serving our clients and ambitious in the solutions we seek. We rely on a culture of collaboration, mutual respect and continuous improvement.

Our corporate values guide the behaviour we display with investors, with each other, with our investee companies and the communities they serve.

Ownership

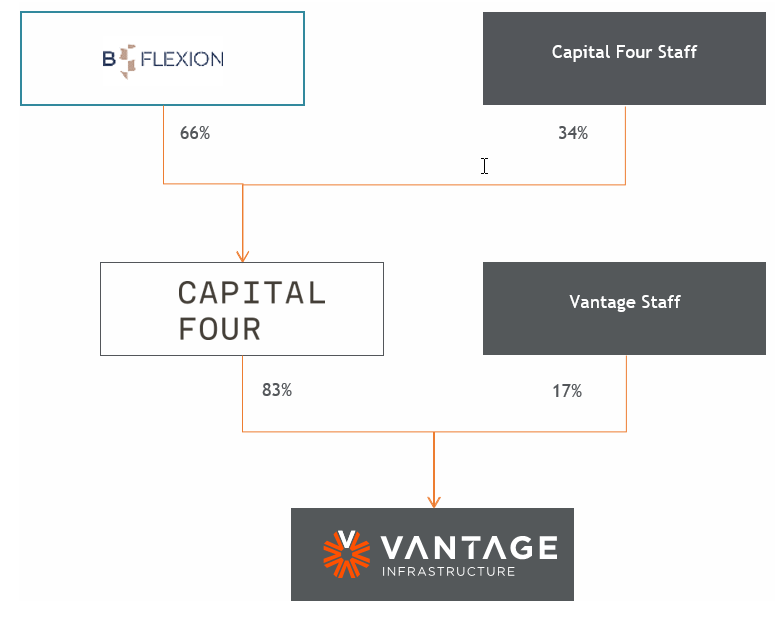

In October 2023, Vantage, its majority shareholder, B-FLEXION, and an affiliate, Capital Four, announced the intention for Vantage and Capital Four to enter into an operating and strategic partnership. The partnership is effective as of Q1 2024, with Capital Four having acquired B-FLEXION’s interest in Vantage and B-FLEXION will remain the majority owner of both entities.

The combined group will manage ~€20bn in liquid high yield debt and private markets strategies with a team of over 150 staff in offices across Europe, United Kingdom and North America. In private markets, the combined group will manage ~€8bn, equally split between Vantage’s funds and mandates and Capital Four’s European private debt fund platform.

The partnership’s purpose is to offer a wider range of boutique and specialized private credit strategies to existing and new investors under a single group. This means a key area of initial collaboration will be in sales and marketing, where Capital Four’s sale and marketing team of ~15 people across Europe and the North America will support the marketing of Vantage funds and mandates to their existing and new clients. In North America, Asia and Australia, Vantage will support the introduction of Capital Four to their investor relationships as well as existing Vantage clients.

Vantage will continue to operate independently with the same investment process, governance structure and management team. The combined group will benefit from a range of operational efficiencies from a global client servicing team while investing more in technology and fund operations to better service the group’s clients.

B-FLEXION and Capital Four will be represented on the Vantage board. Vantage Executive Committee members will represent the interests of Vantage on Capital Four’s executive and operating committees4.

Industry Partnerships and Memberships

We work in partnership with well-recognised industry bodies, including5:

Signatory to the UN Principles for Responsible Investment

Supporter of the Task Force Climate-Related Financial Disclosures

Partnership with Myclimate to reach carbon neutrality

Consortium member and contributor to Moody’s Analytics Project Finance Data Alliance

Investor member of IIGCC

Signatory to the Initiative Climat International (iCI)

Signatory to the Net Zero Asset Managers initiative (NZAM)

All figures as of 30 June 2024

1Full time employees

2AUM includes undrawn commitments and have been converted at a rate of GBP 1 = US$ 1.26

3Score awarded by the United Nations supported Principles for Responsible Investment (PRI) to Vantage Infrastructure’s 2023 survey in Private Infrastructure Debt (5*), Private Infrastructure Equity (5*), Policy, Governance & Strategy (4*), and Confidence Building Measures (4*) modules as of 22 December 2023. GRESB is an industry association score and benchmarks the ESG management and performance of infrastructure fund managers and assets.

4Ownership figures represent an approximation and may fluctuate over time.

5Vantage pays fees to some these organisations to cover the cost of its membership and the services provided, specifically, fees are paid to UN PRI, myclimate, IIGCC